India’s Macroeconomic Stabilization Post-1991 Reforms

Introduction

In the early ‘90s, winds of change swept through the Indian economy, bringing about a transformation that would reshape the nation’s economic landscape. The liberalization, privatization, and globalization policies introduced in 1991 marked a pivotal moment, heralding a new era of economic reforms. As India embraced these changes, the need for effective macroeconomic stabilization became paramount to ensure sustainable growth and stability.

Table of Contents

The Pre-Reform Era

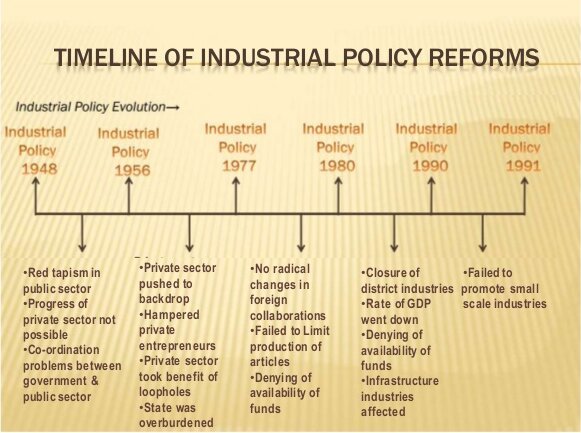

Before delving into the post-1991 scenario, let’s briefly revisit the economic landscape of India prior to the reforms. The country was grappling with a tightly controlled economy, marked by high levels of protectionism, red tape, and limited global integration. While there were pockets of growth, the overall economic framework stifled innovation and hindered competitiveness.

Liberalization Unleashed

The 1991 reforms, spearheaded by then-Finance Minister Dr. Manmohan Singh, dismantled the shackles of a centralized economy. Trade barriers were lifted, industries were deregulated, and the private sector was invited to play a more significant role. This shift towards a more liberalized economy opened doors for foreign investment, fostering a global outlook that would prove crucial in the years to come.

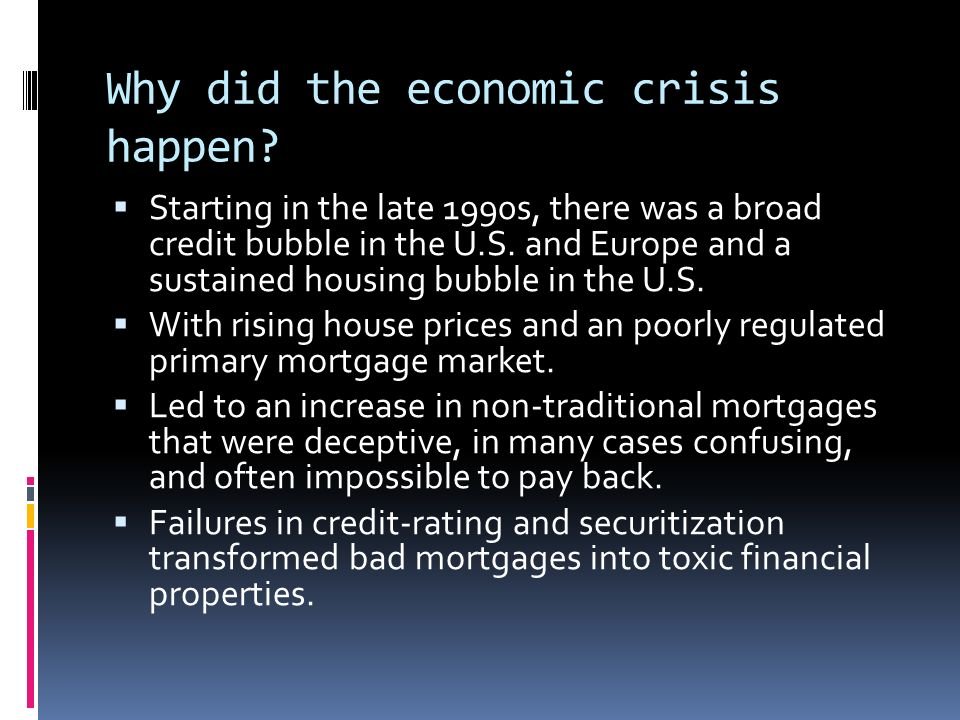

Initial Challenges and Macroeconomic Turbulence

As India embarked on this transformative journey, the initial years were not without challenges. The abrupt shift in economic policies led to short-term disruptions. Inflationary pressures, fiscal imbalances, and external account deficits posed significant hurdles. The need for effective macroeconomic stabilization mechanisms became evident to ensure that the economy sailed smoothly through these turbulent waters.

Fiscal Discipline: A Cornerstone of Stability

One of the key pillars of post-reform macroeconomic stabilization in India was a renewed focus on fiscal discipline. The government implemented measures to control budgetary deficits, rationalize subsidies, and enhance revenue generation. This disciplined approach played a pivotal role in stabilizing the economy and curbing inflationary tendencies.

Monetary Policy: Navigating the Interest Rate Tide

The Reserve Bank of India (RBI) assumed a proactive role in shaping monetary policy to align with the broader economic objectives. By using interest rates as a tool, the RBI aimed to balance inflation and growth. Through a judicious mix of monetary measures, the central bank sought to stabilize prices while fostering an environment conducive to investment and consumption.

Exchange Rate Management: Finding the Right Balance

With globalization opening new avenues for trade and investment, managing the exchange rate became crucial. India transitioned to a more flexible exchange rate regime, allowing market forces to play a greater role. This shift facilitated adjustments to external shocks, making the economy more resilient in the face of global uncertainties.

Structural Reforms: Building a Solid Foundation

Beyond fiscal and monetary measures, structural reforms played a vital role in stabilizing India’s macroeconomic environment. Policies aimed at improving infrastructure, enhancing labor market flexibility, and streamlining regulatory frameworks contributed to creating a more robust foundation for sustained economic growth.

Impact on Growth and Poverty Alleviation

The macroeconomic stabilization efforts post-1991 not only steered the Indian economy away from the choppy waters of instability but also laid the groundwork for robust and inclusive growth. Over the years, India witnessed significant improvements in GDP growth rates, job creation, and poverty alleviation. The burgeoning middle class became a driving force behind the country’s economic expansion.

Challenges and Future Outlook

While India has made substantial progress in macroeconomic stabilization since the reforms, challenges persist. The need for further reforms in areas such as labor, land, and taxation remains on the agenda. Additionally, the global economic landscape is evolving, posing new challenges and opportunities that require nimble policy responses.

In conclusion, the post-1991 era in India represents a fascinating chapter in the nation’s economic history. The journey from a tightly controlled economy to a dynamic, liberalized one was not without its share of hurdles. However, through prudent fiscal and monetary measures, exchange rate flexibility, and structural reforms, India successfully stabilized its macroeconomic environment, paving the way for sustained growth and development. As the nation continues to navigate the complexities of the global economy, the lessons learned from the post-1991 reforms remain invaluable in shaping its future trajectory.

India’s Economic Renaissance: The 1991 Structural Reforms

In the annals of economic history, 1991 holds a significant place for India. It marked the onset of transformative changes that catapulted the nation from the shackles of a stifled economy into the realm of global economic prowess. The 1991 structural economic reforms were a watershed moment, steering India towards liberalization, privatization, and globalization.

Backdrop of Crisis:

The early ‘90s witnessed an economic quagmire in India. High fiscal deficits, burgeoning external debts, and a balance of payments crisis had brought the country to the brink of collapse. The then Finance Minister, Dr. Manmohan Singh, faced the daunting challenge of rescuing the sinking ship.

Liberalization – Unlocking the Economy:

One of the cornerstones of the 1991 reforms was liberalization. India bid adieu to the stifling era of the License Raj, which had throttled entrepreneurial spirit for decades. Industries were freed from the clutches of excessive regulations, and private players were welcomed into sectors that were once reserved exclusively for the public sector.

This shift in policy paved the way for a surge in competition, innovation, and efficiency. The consumer, too, emerged as the ultimate beneficiary with a plethora of choices previously unimaginable. From automobiles to telecommunication, liberalization transformed the Indian economic landscape.

Privatization – Redefining Ownership:

The second pillar of the reforms was privatization. State-owned enterprises, notorious for inefficiencies and bureaucratic red tape, were now on the chopping block. This not only injected a much-needed dose of efficiency but also opened up avenues for private investments.

Strategic sectors like telecommunications and aviation witnessed a sea change as private players brought in not just capital but also managerial expertise. The iconic sale of state-owned enterprises like Maruti Suzuki marked a paradigm shift in the ownership dynamics of the Indian industry.

Globalization – Embracing the World:

Globalization was the third prong of the reforms. India, traditionally a closed economy, decided to open its doors to the world. Trade barriers were dismantled, and foreign direct investment (FDI) was welcomed with open arms. This integration into the global economy brought not only capital but also exposure to international best practices.

Multinational corporations flocked to the Indian market, bringing with them not just products but also technological advancements. The IT boom in the subsequent years can be traced back to this strategic opening of the economy.

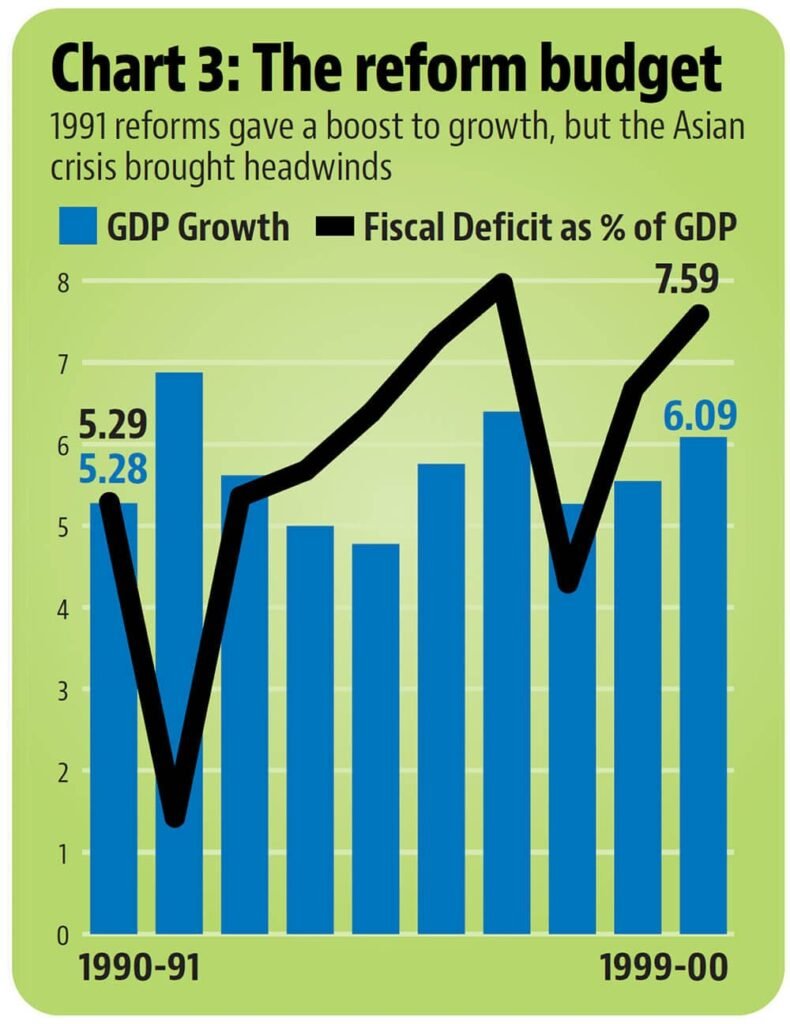

Impact on Growth and Employment:

The impact of the 1991 reforms on economic growth was nothing short of revolutionary. The GDP growth rate, which had been meandering around the 3-4% mark, witnessed a substantial uptick. India, for the first time, started clocking growth rates that put it on the map as an emerging economic powerhouse.

The employment scenario also underwent a transformation. With the surge in entrepreneurial activities and the growth of the private sector, job opportunities burgeoned. The service sector, in particular, experienced unprecedented growth, becoming a major contributor to India’s GDP.

Challenges and Criticisms:

While the reforms undeniably brought about a positive change, they were not without their share of challenges and criticisms. The initial years witnessed a spike in inequality, and certain sectors struggled to cope with the abrupt changes. Critics argued that the reforms favored urban centers, leaving rural areas behind.

Moreover, concerns were raised about the potential exploitation of natural resources and the environment in the pursuit of economic growth. Striking a balance between growth and sustainability became an ongoing challenge.

Legacy and Future Outlook:

The 1991 structural economic reforms undeniably altered the trajectory of India’s economic destiny. The liberalization, privatization, and globalization ushered in an era of unprecedented growth and development. The reforms laid the foundation for subsequent economic policies and positioned India as a key player in the global economic landscape.

As we reflect on the legacy of the 1991 reforms, it becomes imperative to navigate the future with the lessons learned. Sustainable development, inclusive growth, and harnessing the demographic dividend should be at the forefront of India’s economic agenda.

In conclusion, the 1991 structural economic reforms were a defining moment in India’s economic history. They broke the shackles of a stagnant economy and paved the way for a new era of growth and dynamism. As we stand on the shoulders of these reforms, it is crucial to chart a course that ensures equitable and sustainable development for the diverse nation that is India.

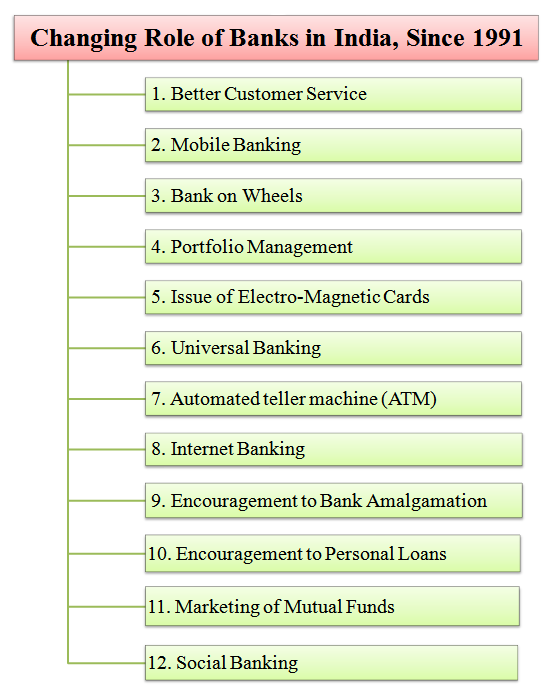

Transforming India’s Financial Landscape: A Closer Look at Financial Sector Reforms

In recent years, India has been undergoing a significant transformation in its financial sector, driven by a series of reforms aimed at fostering economic growth, enhancing transparency, and ensuring financial stability. These reforms are not merely administrative changes but represent a paradigm shift that affects the lives of millions. Let’s delve into the key aspects of the financial sector reforms in India.

1. Digital Revolution:

One of the standout features of the reforms is the digital revolution sweeping through the financial landscape. The introduction of Unified Payments Interface (UPI) has revolutionized the way people transact, making digital payments seamless and accessible to all. From bustling urban centers to remote villages, the digital wave has connected every corner of the country, empowering individuals and businesses alike.

2. Banking for All:

Financial inclusion has been a central theme of the reforms, with initiatives like the Pradhan Mantri Jan Dhan Yojana (PMJDY) aiming to bring the unbanked into the formal banking system. Opening bank accounts for all, coupled with direct benefit transfers, ensures that the fruits of economic development reach even the most marginalized sections of society.

2. Banking for All:

Financial inclusion has been a central theme of the reforms, with initiatives like the Pradhan Mantri Jan Dhan Yojana (PMJDY) aiming to bring the unbanked into the formal banking system. Opening bank accounts for all, coupled with direct benefit transfers, ensures that the fruits of economic development reach even the most marginalized sections of society.

3. Insolvency and Bankruptcy Code (IBC):

The introduction of the Insolvency and Bankruptcy Code (IBC) has been a game-changer, streamlining the resolution process for stressed assets. This not only instills confidence among investors but also ensures that capital tied up in non-performing assets is efficiently reallocated, fostering a healthier and more dynamic financial environment.

4. Regulatory Reforms:

Regulatory reforms have played a pivotal role in shaping the financial sector’s trajectory. The merger of public sector banks, for instance, aims to create stronger, more resilient entities capable of withstanding economic shocks. Simultaneously, the regulatory framework has been fine-tuned to strike a balance between promoting innovation and safeguarding the interests of consumers.

5. Securities Market Reforms:

The securities market has witnessed a slew of reforms designed to enhance transparency and efficiency. The introduction of Real Estate Investment Trusts (REITs) and Infrastructure Investment Trusts (InvITs) provides new avenues for investors, while initiatives like e-KYC (Know Your Customer) simplify onboarding processes, making it easier for individuals to participate in the capital markets.

6. Fintech Integration:

The collaboration between traditional financial institutions and fintech companies has been a hallmark of the reforms. Fintech integration not only enhances the delivery of financial services but also promotes innovation in areas such as lending, insurance, and wealth management. This synergy brings forth a dynamic financial ecosystem that is responsive to the evolving needs of a rapidly growing economy.

7. Sustainable Finance:

Recognizing the importance of sustainability, the financial sector reforms in India have also incorporated elements of responsible and green finance. Encouraging investments in environmentally friendly projects and promoting sustainable business practices align with the global commitment to address climate change and ensure long-term economic resilience.

In conclusion, India’s financial sector reforms represent a holistic effort to create a robust and inclusive financial system that catalyzes economic growth and empowers every citizen. From the urban professional making digital transactions to the farmer accessing formal credit, the reforms touch the lives of all, underscoring the transformative power of well-crafted financial policies. As India continues on this trajectory, the hope is that these reforms will lay the foundation for a more prosperous, equitable, and resilient economic future.