Trade Policy in India’s Post-Reform Era

In the vast tapestry of India’s economic landscape, trade policy plays a pivotal role, acting as a dynamic force that shapes the nation’s interactions with the global economy. As we step into the post-reform period, it’s crucial to understand the nuances and impact of India’s trade policies on both domestic industries and international relations.

A Prelude to Reforms:

Table of Contents

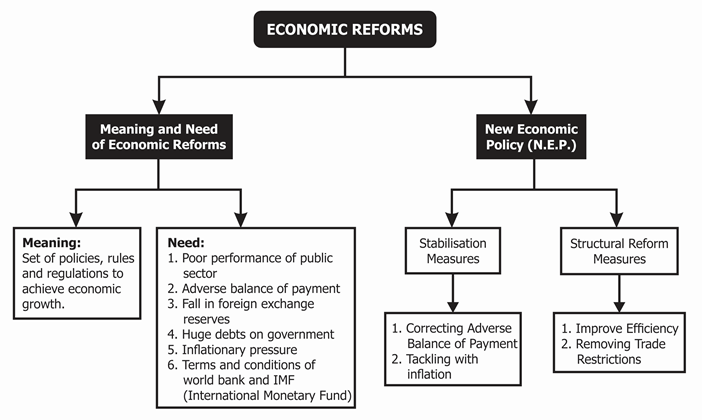

India’s economic liberalization journey began in the early 1990s, with the intent to break free from the shackles of a closed, regulated economy. The government embraced reforms to foster economic growth, attract foreign investment, and enhance competitiveness on the global stage.

As stated earlier, the period after 1991 has been marked by a substantial liberalisation of the trade policy. While some liberalisation measures were the result of the conviction among government circles that they were necessary to make exports competitive in the international market, some were undertaken under the pressure of the international agencies, as a part of the stabilisation and structural adjustment programme.

Moreover, with India joining the WTO (World Trade Organisation) in 1995 as a founder member, it is under an obligation to strike down all quantitative restrictions on imports and reduce import tariffs so as to ‘open up’ the economy to world trade and the forces of globalisation.

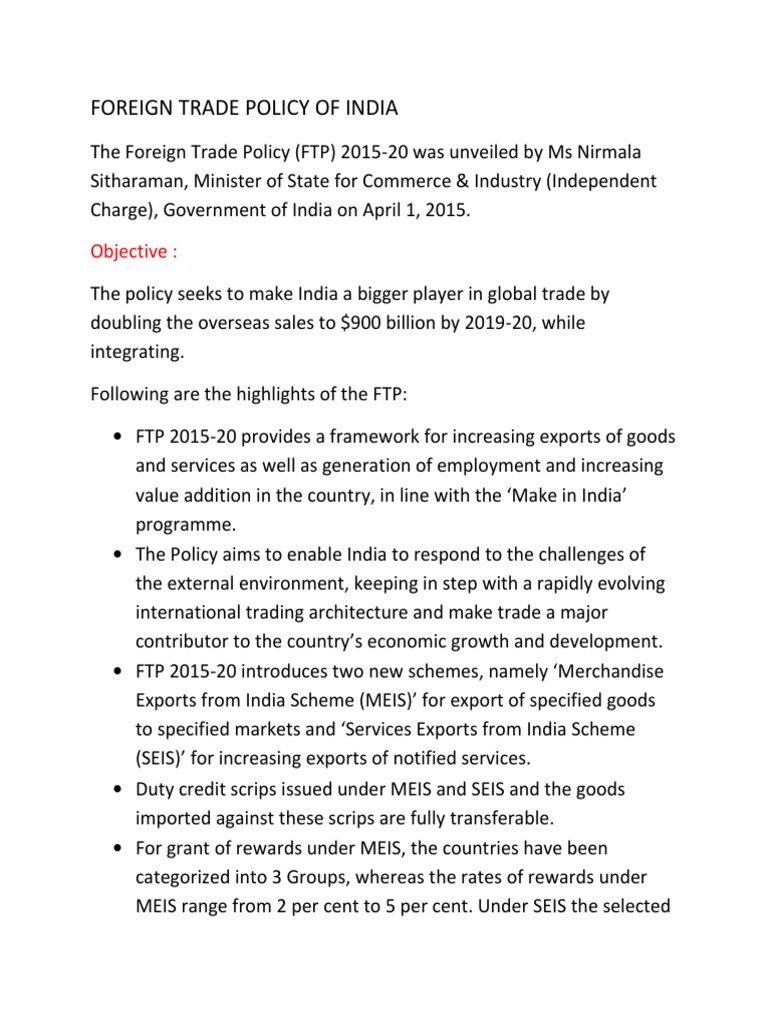

The main features of the new trade policy as it has evolved over the years since 1991 are as follows:

Freer Imports and Exports:

In the pre-reform period, India’s trade policy regime was complex and cumbersome. There were different categories of importers, different types of import licences, alternate ways of importing etc.

The Exim Policy 2000-01 removed quantitative restrictions on 714 items and the Exim Policy 2001-02 removed quantitative restrictions on the balance 715 items. Thus, in line with India’s commitment to the WTO, quantitative restrictions on all import items have been withdrawn.

Rationalisation of Tariff Structure:

In its Final Report published in January 1993, Chelliah Committee had expressed the opinion that the rupee had depreciated considerably in the 1980s and the early 1990s, pushing up the level of protection to Indian industries considerably.

Decanalisation:

A large number of exports and imports used to be canalised through the public sector agencies in India. The supplementary trade policy announced on August 13, 1991 reviewed these canalised items and decanalised 16 export items and 20 import items. The 1992-97 policy decanalised imports of a number of items including newsprint, non-ferrous metals, natural rubber, intermediates and raw materials for fertilizers.

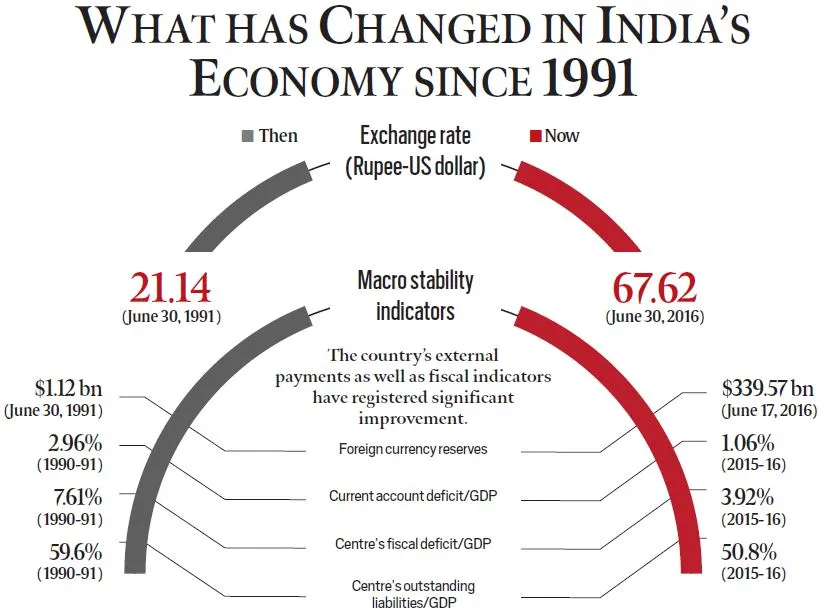

Convertibility of Rupee on Current Account:

The government made a two -step downward adjustment of 18-19 per cent in the exchange rate of the rupee on July 1 and July 3, 1991. This was followed by the introduction of partial convertibility of rupee in 1992-93, full convertibility on the current account in August 1994. Substantial capital account liberalisation measures have also been announced in recent years.

The exchange rate of the rupee is now market – determined . Thus, exchange rate policy in India has evolved from the rupee being pegged to a market related system (since March 1993).

Export-related Policies:

Export policies have been reformed significantly since the early 1990s. Now, exporters have a self-assessment system to facilitate trade policy. Currently, about 80 per cent transactions are cleared without intervention by customs and 98 per cent of documents are processed electronically.

Trading Houses:

The 1991 trade policy allowed export houses and trading houses to import a wide range of items. The Government also permitted the setting up of trading houses with 51 per cent foreign equity for the purposes of promoting exports.

Special Economic Zones:

A scheme for setting up Special Economic Zones (SEZs) in the country to promote exports was announced by the government in the Export and Import Policy on March 31, 2000. To instill confidence in investors and signal the government’s commitment to a stable SEZ policy regime, the Special Economic Zones Act, 2005, was passed by Parliament in May 2005. The SEZ Act, 2005, support by SEZ Rules, came into effect on February 10, 2006.

EOU scheme:

The Export-Oriented Units (EOUs) scheme introduced in early 1981, is complementary to the SEZ scheme. It offers a wide option in locations with reference to factors like source of raw materials, ports of export, hinterland facilities, and availability of technological skills, existence of an industrial base and the need for a larger area of land for the project. The EOUs have put up their own infrastructure.

Agriculture Export Zones:

The Exim Policy 2001 introduced the concept of Agri Export Zones (AEZs) to give primacy to promotion of agricultural exports and effect a reorganization of our export efforts on the basis of specific products and specific geographical areas.

Market Access Initiative Scheme:

Market Access Initiative scheme was launched in 2001-02 for undertaking marketing promotion efforts abroad.

The key features of the scheme are in-depth Market Studies for select products in chosen countries to generate data for promotion of exports from India, assist in promotion of India, Indian products and Indian brands in the international market by display through showrooms and warehouses set up in rental premises by identified exporters, display in identified leading departmental stores/total exhibitions/trade fairs, etc.

Five Thrust Sectors:

The Foreign Trade Policy (2004-09) announced specific strategies (termed Special Focus Initiatives) for five sectors: Agriculture, Handicrafts, Handlooms, Gems and Jewellery, and Leather and Footwear sector.

Served from India to be built as a brand:

Presently, services contribute more than 50 per cent of the country’s GDP. To provide a thrust to service exports, FTP (2004-09) advocated a number of steps like: (1) ‘Served from India ‘ brand will be created to catapult India the world over as a major global services hub; (2.) An exclusive Export Promotion Council for services would be set up in order to tap opportunities in key markets, and develop strategic market access programmes; (3.)

Individual service providers who earn foreign exchange of at least RS 5 lakh, and other service providers who earn foreign exchange of at least RS 10 lakh would be eligible for a duty credit entitlement of 10 per cent of total foreign exchange earned by them, etc.

Setting up of Free Trade and Warehousing Zones (FTWZs):

The FTP (2004-09) introduced a new scheme to establish Free Trade and Warehousing Zones (FTWZs) to create trade -related infrastructure to facilitate the import and export of goods and services with freedom to carry out trade transactions in free currency.

Reducing transactional costs and simplifying procedures:

The FTP (2004-09) announced a number of ‘rationalisation measures ‘ to reduce transactional costs and simplify procedures. These included: (a) All exporters with minimum turnover of RS 5 crore exempted from furnishing bank guarantee (this was aimed to help small exporters who incur high transactional costs); (b) Import of second-hand capital goods permitted without any age restrictions; (c) All goods and services exported, including those from DTA (domestic tariff area) units, exempted from service tax; (d) The number of returns and forms to be filed reduced, etc.

Concessions and Exemptions:

A large number of tax benefits and exemptions have been granted to liberalise imports and promote exports. These include reduction in the peak rate of customs duty to 10 per cent; significant reduction in duty rates for critical inputs for the Information Technology sector, which is an important export sector; grant of concessions for building infrastructure by way of 10 years tax holiday to the developers of SEZs; facilities and tax benefits to exporters of goods and merchandise; reduction in the customs duty on specified equipment for Ports and Airports to 10 per cent to encourage the development of world-class infrastructure facilities, etc.

Services Trade Reforms:

Services sector has proved to be an important source of foreign exchange earnings in India. In fact, as noted by Harsha Vardhana Singh, “India is widely seen as more prominent in services exports than manufacturing and has served as a model for several other developing nations to seek opportunities from international trade in services.”

Trade Facilitation:

Trade facilitation policies include a focus on timeliness, transparency, paperless procedures (domestic and cross-border), simplifying procedural formalities, and institutional arrangement as well as domestic and international cooperation.

A Critical Evaluation of the New Trade Policy

The trade policy reforms initiated in 1991 have drastically changed the foreign trade scenario and have resulted in the shift from inward-oriented to an outward-oriented policy.

Relative importance of the home market:

As far as the issue of the relative importance of the home market is concerned, Deepak Nayyar argues that in large countries like India, where the domestic market is overwhelmingly important, sustained industrialization can only be based on the growth of the internal market.

The nature or the degree of State intervention:

As far as the issue of State intervention in the process of industrialization is concerned, the experience of the second half of the twentieth century shows that the guiding and supportive role of the State has been at the foundations of successful development among the late industrialisers.

Acquisition or development of technology:

As far as the issue of technology is concerned, Nayyar argues that the existing market structure and trade policy framework have not combined to provide an environment that could accelerate the absorption of imported technology and foster the development of indigenous technology, or create a milieu which could be conducive to diffusion and innovation.

The solutions to the problems of the national economy cannot be found through the foreign trade policy sector or simple recipes associated with it.

The Evolution of Trade Policies:

As the winds of change swept through the nation, trade policy underwent a transformation, shedding the protectionist cloak that had defined earlier eras. The shift towards a more open economy was marked by reductions in tariffs, simplification of trade policy procedures, and the dismantling of licensing regimes.

Embracing Globalization:

The post-reform period witnessed India integrating into the global economy with increased vigor. Trade agreements and partnerships became key instruments in fostering economic ties with nations far and wide. The aim was clear – to boost exports, attract foreign direct investment (FDI), and unleash the latent potential of Indian industries.

Striking the Balance:

While the benefits of globalization were evident, the challenges were equally formidable. Policymakers were tasked with striking a delicate balance – promoting international trade without compromising the interests of domestic industries. Safeguard measures and anti-dumping policies became critical tools to protect against unfair trade policy practices.

Challenges and Opportunities:

Navigating the post-reform trade policy landscape brought forth a set of challenges and opportunities. Domestic industries, particularly in sectors facing stiff global competition, had to adapt to the new paradigm. On the flip side, the opening up of markets provided Indian businesses with a platform to showcase their capabilities and tap into global demand.

E-Commerce and Digital Trade:

The digital revolution further reshaped the trade scenario. E-commerce emerged as a powerful channel for trade policy, connecting buyers and sellers across borders. Policymakers had to grapple with the complexities of regulating digital trade policy, ensuring a level playing field while fostering innovation and entrepreneurship.

Sustainability in Focus:

In the post-reform era, the lens on trade policy expanded to include sustainability considerations. India’s commitment to environmental responsibility prompted the incorporation of eco-friendly practices in trade. Striking a balance between economic growth and environmental stewardship became imperative for a sustainable future.

Recent Developments:

As we fast-forward to the present, India’s trade policy continues to evolve. Bilateral and multilateral agreements are on the rise, with an emphasis on creating mutually beneficial partnerships. The nation’s geopolitical positioning plays a crucial role in shaping its trade policy, as it seeks to enhance its influence on the global stage.

Conclusion:

In the post-reform period, India’s trade policy journey has been one of transformation, adaptation, and growth. From dismantling protectionist barriers to embracing globalization, the nation has come a long way. Navigating the delicate balance between fostering international trade policy and protecting domestic interests remains an ongoing challenge. As India continues to engage with the global economy, the future of its trade policy holds the promise of innovation, sustainability, and mutually beneficial collaborations.