India’s Economic Evolution: A Journey Through the India's Balance of Payments Since 1991

Introduction:

India’s balance of payments (BoP) is like the financial report card of a country, detailing its economic transactions with the rest of the world. Since the liberalization of the Indian economy in 1991, the India’s balance of payments (BoP) has been on a rollercoaster ride, reflecting the dynamic shifts in global trade, investment, and policy changes.

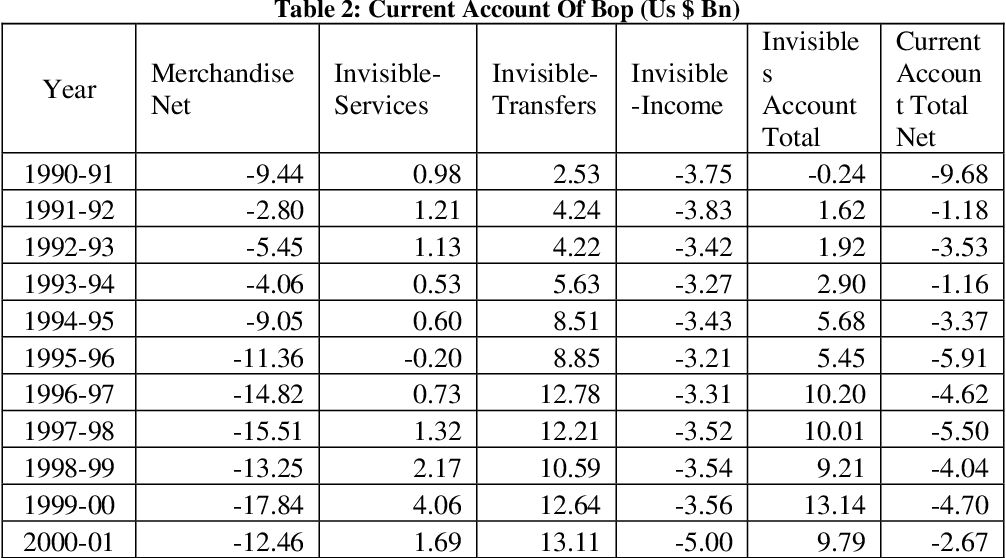

The balance of payments situation since 1991 has been distinctly different from the situation that prevailed in the earlier period excepting the years 1991-92 and 1992-93. Since 1991-92 was an exceptional year, it is left out of discussion.

The situation in 1992-93 was bad as imports grew by 15.4 per cent on India’s balance of payments basis while the growth of exports was just 3.3 per cent on India’s balance of payments basis. The import cover of foreign exchange reserves was only 4.9 months in this year.

However, India’s balance of payments situation improved considerably in 1993-94 with exports increasing by 20.2 per cent on India’s balance of payments basis as against only 10.2 per cent increase in imports.

The current account deficit in this year was $ 1,158 million which was just 0.4 per cent of GDP. With capital account surplus of $ 9,882 million, there was a reserve accumulation of as much as $ 8.7 billion. The import cover of foreign exchange reserves rose to eight -and-a-half months in this year while it was only 4.9 months in 1992-93. All these facts show that there was a marked ‘turnaround’ in the India’s balance of payments situation in 1993-94.

From the point of view of balance of payments, most significant have been the last year of the Ninth Plan, 2001-02 and the first two years of the Tenth Plan, 2002-03 and 2003-04. In these three years, there was a surplus on current account. The surplus on current account was 0.7 per cent of GDP in 2001-02, 1.2 per cent of GDP in 2002-03 and 2.3 per cent of GDP in 2003-04.

It is the first time in post -Independence period that there was a current account surplus for three consecutive years. This surplus was also accompanied by strong net capital inflows. As a result, there was substantial reserve accumulation. The reserve build-up rose to as high as $ 31.4 billion in 2003-04.

Trade deficit in the first year of the Twelfth Plan, 2012-13, rose to $ 195.6 billion (the highest recorded so far). Net earnings from invisibles were $ 107.5 billion leaving a current account deficit of $ 88.2 billion which was as high as 4.8 per cent of GDP.

However, there was a marked improvement in 2013-14 with the current account deficit being contained at $ 32.4 billion as against $ 88.2 billion in 2012-13. This improvement was basically due to a reduction in trade deficit by as much as $ 48 billion ( from $ 195.6 billion in 2012.13 to $ 147.6 billion in 2013-14).

Of the total reduction of $ 48.0 billion in trade deficit, reduction in imports of gold and silver contributed approximately 47 per cent, reduction in non-POL and non-gold imports constituted 40 per cent, and change in exports constituted 25 per cent.

Higher imports under POL and non-DCCI&S (Directorate General of Commercial Intelligence and Statistics) imports contributed negatively to the process of reduction to the extent of 12 per cent in 2013-14 over 2012-13.

As a proportion of GDP, the CAD was only 1.7 per cent of GDP in 2013-14. Since net capital inflows in 2013-14 was $ 47.9 billion while CAD was $ 32.4 billion, there was a reserve accretion of $ 15.5 billion. The accretion to reserves helped in increasing the level of foreign exchange reserves above the $ 300 billion at end-March 2014.

Table of Contents

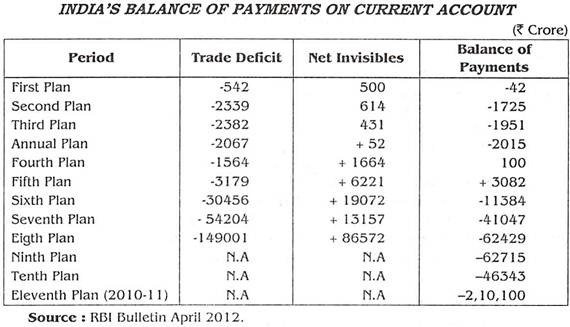

Pre-1991: The Closed Economy Era

Before 1991, India operated as a closed economy, heavily regulated by the government. This period was characterized by limited foreign trade and stringent controls on currency movements. The India’s balance of payments (BoP) situation during these years was often challenging, marked by persistent current account deficits and dwindling foreign exchange reserves.

1991 Liberalization: Winds of Change

The turning point came in 1991 when India embraced economic liberalization. The government introduced a series of reforms, dismantling trade barriers, promoting foreign direct investment (FDI), and allowing the exchange rate to be determined by market forces. These changes had a profound impact on the India’s balance of payments (BoP).

Initial Challenges: Rising Current Account Deficits

In the immediate aftermath of liberalization, India faced challenges in adjusting to the new economic order. Current account deficits widened as imports surged due to increased consumer demand for foreign goods. However, this phase was seen as a temporary adjustment period.

The IT Boom: A Boon for Exports

The late 1990s and early 2000s witnessed a technological revolution, with India emerging as a global IT hub. This boom played a crucial role in transforming the BoP dynamics. Exports of software services and IT-enabled services surged, helping to bridge the current account gap.

Globalization and Trade Surpluses

As globalization gained momentum, India’s trade landscape evolved. The 2000s saw a shift towards trade surpluses, with exports outpacing imports. The diversification of India’s export basket, including sectors like pharmaceuticals, textiles, and services, contributed to a more favorable India’s balance of payments (BoP) position.

Financial Flows: FDI and Portfolio Investments

Foreign Direct Investment (FDI) became a crucial component of India’s balance of payments (BoP). Sectors like telecommunications, retail, and manufacturing attracted significant foreign investments. Additionally, portfolio investments in the stock and debt markets played a role in stabilizing capital flows.

Current Account Challenges: Oil Price Volatility

India’s dependency on oil imports continued to pose challenges. Fluctuations in global oil prices impacted the country’s current account balance, leading to periodic concerns. Strategic initiatives to diversify energy sources and promote renewable energy aimed to mitigate this vulnerability.

Post-2010: Current Account Deficits Resurface

The post-2010 period saw a resurgence of current account deficits. Factors such as slowing global demand, domestic policy uncertainties, and a widening trade gap contributed to the challenges. Policymakers grappled with the need to balance economic growth with external stability.

Resilience Amidst Global Headwinds

Despite periodic challenges, India demonstrated resilience in the face of global economic uncertainties. Prudent macroeconomic policies, foreign exchange reserve management, and targeted reforms helped navigate through turbulent times, preventing a severe India’s balance of payments (BoP) crisis.

The Road Ahead: Sustaining Balance

Looking forward, sustaining a favorable India’s balance of payments (BoP) requires a holistic approach. Continued focus on export diversification, attracting high-quality FDI, and managing external vulnerabilities will be crucial. Strengthening domestic industries, enhancing competitiveness, and embracing sustainable development practices will play a pivotal role in shaping India’s balance of payments (BoP) in the coming years.

Reasons for Satisfactory Balance of Payments Situation in Post-Reform Period

As it clear from above discussion, the balance of payments situation since 1991 has been quite satisfactory. Excepting the years 1995-96, 2008-09 and 2011-12, there has been substantial reserve accumulation over the period 1993-94 to 2016-17. The reasons for this satisfactory position are as follows:

High Earnings from Invisibles:

Earnings from invisibles exceeded the deficit on trade account in 2001-02, 2002-03 and 2003-04 with the result that there was a surplus on current account in these years. In 2015-16 and 2015-17, invisibles covered 83.0 per cent and 86.4 per cent of trade deficit respectively.

With $ 68.9 billion, India was the largest recipient of private remittances in 2017 followed by China that got $ 64.0 billion.

It is on account of the above reason that Shankar Acharya has argued that it is the surges in software exports and private remittances that are the main new contributors to improvement in the India’s balance of payments situation in recent years.

Rise in External Commercial Borrowings:

External commercial borrowings were used extensively in the latter half of 1980s to finance the current account deficit. In fact, in this period, external commercial borrowings accounted for more than 25 per cent of the total capital inflows into the economy.

During some years in 1990s also, the dependence on external commercial borrowings has been quite high. For instance, of the total capital inflows of $ 4,563 million in 1991-92, the share of external commercial borrowings was $ 1,456 million, i.e., 31.9 per cent

External commercial borrowings rose to $ 22,610 million in 2007-08 but fell subsequently. They were $11,777 million in 2013-14 and only $ 1,570 million in 2014-15. External commercial borrowings were negative in 2015-16 and 2016-17.

Non-Resident Deposits:

In addition to external commercial borrowings, the period of 1980s saw considerable increase in non-resident deposits also. This phenomenon continued right through the 1990s as well. In fact, the government has been offering various incentives to the non-residents Indians to bolster foreign exchange reserves of the country.

However, there were net outflows from non-resident deposits in the year 2004-05 for the first time since 1990-91. NRI deposits rose significantly to $ 38,892 million in 2013-14 in response to special incentives given by the Reserve Bank of India and stood at $ 16,052 million in 2015-16.

However, there was a net outflows of $ 12,367 million from NRI deposits in 2016-17, following lumpy redemption of FCNR(B) deposits raised by banks during September to November 2013.

Role of Foreign Investment:

Since 1991 the government has been offering various concessions, facilities and incentives to the foreign investors with a view to encouraging foreign investment into the country. These measures have helped in increasing foreign investment substantially in recent years. In many years since 1991 the share of foreign investment has been half or even more in total capital inflows (net) into the country. In 2016-17, foreign investment at $ 43.2 billion exceeded total (net) capital inflows of $ 36.5 billion.

Conclusion:

India’s journey through the India’s balance of payments since 1991 reflects the nation’s resilience and adaptability in the face of global economic shifts. From the challenges of liberalization to the booms in IT and globalization, the story is one of transformation. As India navigates the road ahead, maintaining a delicate balance between economic growth and external stability will be key to ensuring a robust and sustainable India’s balance of payments (BoP) position.