Managing India’s Balance of Payments

Introduction:

The dynamic nature of international trade and finance is a crucial aspect of a country’s economic well-being. In the case of India, the management of the Balance of Payments (BoP) is akin to steering a ship through ever-changing global waters. This article delves into the intricacies of how India manages its BoP and the factors that influence this delicate equilibrium.

Understanding Balance of Payments:

At its core, the Balance of Payments is a comprehensive record of a country’s economic transactions with the rest of the world. It includes the trade balance, capital flows, and financial transfers. In simpler terms, it’s a measure of how much a country is earning and spending on an International scale.

India’s Trade Balances:

India has traditionally faced challenges in maintaining a favorable trade balance. While the country is a significant player in the global market, exporting software, textiles, and pharmaceuticals, it also relies heavily on imports for items like oil, machinery, and electronic goods. Striking a balance between exports and imports is crucial to avoid trade deficits that can strain the Balance of Payments (BoP).

Export Promotion Strategies:

To enhance its position in the global market, India has implemented various export promotion strategies. These include financial incentives, improving infrastructure, and simplifying export procedures. By fostering a conducive environment for businesses, the aim is to boost exports and narrow the trade gap.

Foreign Direct Investment (FDI) and Foreign Institutional Investment (FII):

India actively encourages foreign investments to strengthen its Balance of Payments (BoP). Policies promoting FDI in key sectors like retail, manufacturing, and technology aim to attract long-term investments. Simultaneously, measures are taken to regulate and monitor FII to prevent excessive volatility in financial markets.

Managing Exchange Rates:

The value of the Indian rupee in comparison to other currencies is a critical factor influencing the Balance of Payments (BoP). A carefully managed exchange rate can boost exports by making Indian goods more competitive on the global stage. However, striking the right balance is essential to prevent adverse effects on inflation and debt levels.

Reserves and Interventions:

Maintaining a healthy foreign exchange reserve is a key strategy to weather economic uncertainties. India often intervenes in the foreign exchange market to stabilize the rupee and prevent sudden depreciation. These interventions help in securing a cushion against external shocks.

Global Economic Trends:

India’s Balance of Payments (BoP) is not an isolated entity but is deeply influenced by global economic trends. Fluctuations in commodity prices, geopolitical events, and shifts in demand and supply at the global level can impact India’s trade dynamics. Therefore, policymakers must stay vigilant and adapt strategies to navigate these external factors.

Challenges and Future Outlook:

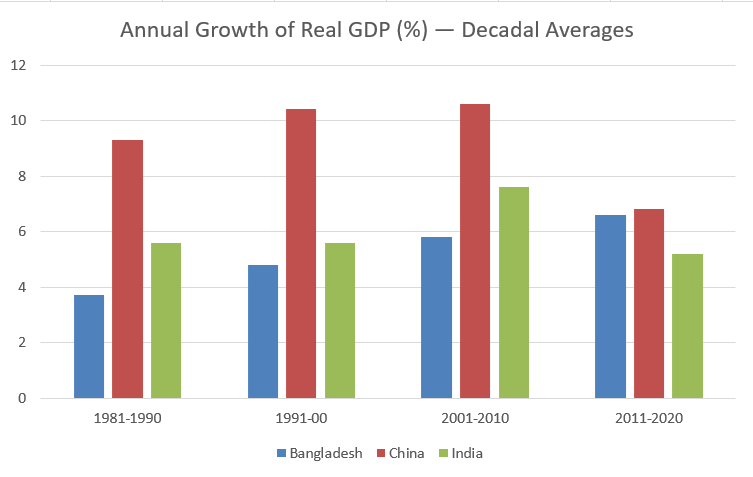

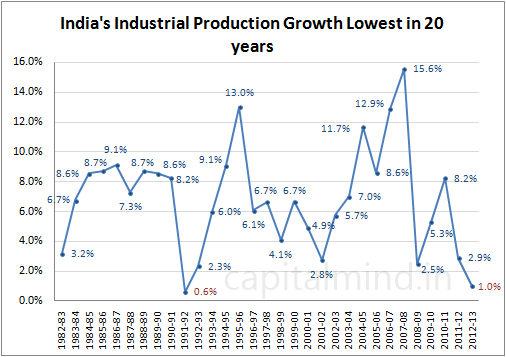

Despite India’s efforts to manage its Balance of Payments (BoP), challenges persist. The rising oil prices, geopolitical tensions, and the aftermath of global economic downturns pose continuous challenges. However, India’s robust domestic demand, diverse economy, and ongoing reforms position it well for resilience in the face of uncertainties.

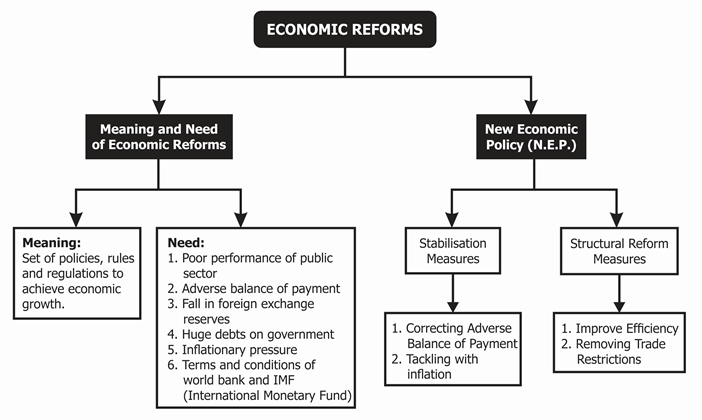

Linkages between Fiscal and External Policies

As noted by C. Rangarajan, imbalances in the external sector reflect the fundamental fact that aggregate absorption in the economy is in excess of the domestically produced goods and services.

Current Account Deficit = Income – (Consumption + Investment + Government Expenditure) = Fiscal Deficit + (Private Saving –Investment Gap)

In symbols, we can write

X – M = Y –(C+I+G) = (T –G) + (Sp—Ip )

While this is merely an ex post identity, it does bring out an important policy issue. It explicitly shows that an improvement in the current account balance can be achieved either by an improvement in the balances of the public sector (T—G) and the private sector (Sp—Ip) combined, or by an increase in national income (Y) relative to domestic absorption (C+I+G).

In a situation of crisis, the identity implies that serious policy measures aimed at curtailing domestic absorption will be a necessary prerequisite for improving the external situation.

Issues Relating to Trade Strategy

Trade strategies can be broadly divided into two groups, outward-oriented. An outward-oriented strategy is one in which trade and industrial policies do not discriminate between production for the domestic goods and foreign goods. As against this, inward-oriented strategy is one in which trade and industrial incentives are biased in favour of production for the domestic market over the export market.

Import Substitution Policy in India: Constraints to Growth:

India opted for a strongly inward-oriented strategy in the early decades of economic planning. The basic rationale for adopting this strategy was that it would help rapid industrialization through import substitution and at the same time save valuable foreign exchange.

According to the WDR, the main advantage of the outward-oriented strategy over the inward-oriented strategy is that it promotes the efficient use of resources.

As against the above, inward-oriented strategy (i.e., the import substitution strategy) leads to high levels of effective protection. The currency becomes over valued and export are discouraged.

Trade Policy Options for India:

The message of the above discussion is clear enough – India should go in for globalisation and open up its economy considerably by liberalising the import – export regime. This would imply the conversion of quantitative restrictions to low and uniform tariffs, and the use of the exchange rate (rather than quantitative restrictions or tariffs) for bringing about balance of payments equilibrium.

There is a strong support for this policy among many economists and international financial institutions. In fact, the policy package offered by the World Bank and IMF to the developing countries facing balance of payments problems in the 1980 s, specifically included import liberalisation and a more ‘open’ trade and industrial policy as a condition for the grant of assistance.

Exchange Rate Management:

Exchange rate management plays a role complementary to trade policy. This is on account of the fact that exchange rate movements can be used for correcting the imbalances in the current account of the balance of payments. I India, prior to 1991, the rupee was pegged to the US dollar, pound sterling or a basket of currencies of India’s major trading partners. In July 1991 when the Government of India announced major trade and industrial policy liberalisation measures, a two-step downward adjustment of 18-19 per cent was carried out in the exchange rate of the Indian rupee.

This was expected to help the country in increasing the export earnings and thus in tackling the serious imbalances in the balance of payments. On the basis of the Report of the High Level Committee on Balance of Payments chaired by C. Rangarajan, the government introduced partial convertibility of rupee in 1992-93 Budget known as liberalised exchange rate management system (LERMS). This was followed by market-determined exchange rate regime in 1993.

The exchange rate is now largely determined by the market, i.e., demand and supply conditions. However, Reserve Bank intervenes to check excessive volatility in the market. Such an exchange rate regime is known as the ‘managed float ‘ regime.

Issues Pertaining to the Capital Account:

External Commercial Borrowings:

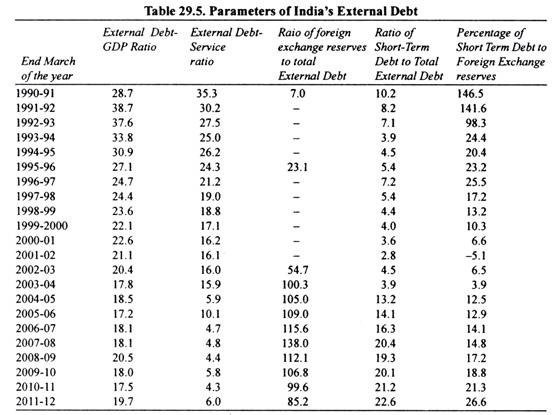

Before 1980s almost the entire deficit in current account was financed by concessional assistance. However, in 1980s (particularly in the latter half of 1980s), dependence on external commercial borrowings increased significantly due to increasing shortage of concessional assistance. During 1990s also, the dependence of the country on external commercial borrowings was quite high.

Since external commercial borrowings are obtained at high rates of interest, the dependence on high cost methods of financing increased.

Non-Resident Deposits:

During 1985-90, non-resident deposits accounted for 23 per cent of the financing need. In a large measure, the inflow of funds under these deposits was a response to conscious policy incentives in the forms of attractive interest rate differentials, exchange risk guarantees to banks and fiscal concessions.

Short-term Debt:

At times, countries resort to short term debt to bridge the balance deficit. For instance, in India, short-term debt constituted 10 per cent of total external debt at end-March 1990. However, this money is frequently ‘hot money ‘ which moves across countries in search of high returns.

External Debt:

A country’s external indebtedness is a ‘mirror image ‘ of the behaviour of the current account in the balance of payments. In this sense, the outstanding volume of India’s external debt represents the accumulation of deficits in the current account over the past years.

India’s external debt was $ 83.8 billion at end-march 2017. According to World Bank, India is the third most indebted country among developing countries in terms of stock of external debt after China and Brazil.

Foreign Currency Reserves and Reserve Management Strategy:

The payment crisis of 1991-92 understood the acute problem of liquidity and international confidence that arise when foreign exchange reserves are depleted to finance overall deficits in the balance of payments.

Accordingly, the Reserve Bank of India has attempted to build up adequate stocks of foreign exchange reserves to meet any contingencies arising out of the size of the current account deficit, short-term liabilities, the possible variability in portfolio investments and other type of capital flows, the unanticipated pressures on the balance of payments arising out of external shocks, movements in repatriable foreign currency deposits of non-resident Indians etc.

The foreign exchange position improved considerably on all other norms of adequate as well. For instance, the ratio of foreign exchange reserves to external debt rose from 7.0 per cent in 1990-91 to 72 per cent in 2002-03 and further to 138 per cent at end-March 2008. Thus, the foreign exchange reserves exceeded the external debt at end-March 2008(by as much as $ 85.3 billion).

However, because of global recession in 2008-09 and capital outflows, the foreign exchange reserves fell subsequently. Foreign exchange reserves stood at $ 370 billion at end-March 2017. The import cover of foreign exchange reserves was 8.9 months in 2014-15 which rose to 11.3 months in 2016-17.

Conclusion:

The management of India’s Balance of Payments is a nuanced task that requires a delicate balance between promoting exports, attracting investments, and maintaining exchange rate stability. As the country sails through the complex waters of international trade, the adaptability of policies and the ability to respond to global economic shifts become paramount.

With a strategic approach and continuous vigilance, India aims to not only navigate the currents but also thrive in the ever-evolving landscape of the global economy.