An In-Depth Look at the Indian Share Market

The Indian share market, often referred to as the stock market, plays a crucial

role in the country’s economy, acting as a barometer of financial health and

investor sentiment. The market is composed of two primary exchanges: the

Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE), both

of which provide platforms for the trading of various securities, including

stocks, bonds, derivatives, and commodities. Let’s dive into the intricacies of

the Indian share market, its structure, functioning, and its importance to

investors and the economy.

A Brief History of the Indian Share Market

The Bombay Stock Exchange (BSE), established in 1875, is Asia’s oldest stock

exchange and one of the world’s largest in terms of the number of companies

listed. Meanwhile, the National Stock Exchange (NSE) was founded in 1992 to

bring more transparency and efficiency to the Indian markets through

electronic trading. Both exchanges have since become central pillars of

India’s financial system, with the NSE gaining prominence due to its

sophisticated technology and larger trading volumes.

Structure of the Indian Share Market

The Indian share market can be broadly categorized into two segments:

1. Primary Market : This is where companies issue new securities to raise

capital through Initial Public Offerings (IPOs) or follow-on public

offerings. Investors purchase these securities directly from the issuing

company. The primary market helps companies access funds for

expansion, debt repayment, or other corporate activities.

2. Secondary Market : Once securities are issued in the primary market,

they are traded among investors in the secondary market. The BSE and

NSE provide the platform for this trading. The prices of securities in the

secondary market fluctuate based on supply and demand, investor

sentiment, and various economic factors.

Key Indices

Indices are crucial for gauging the performance of the stock market. In India,

the two most notable indices are:

S&P BSE Sensex : A benchmark index of the BSE, it comprises 30

financially sound and well-established companies from different

sectors. The Sensex reflects the overall performance of the BSE and is

often seen as a barometer of the Indian economy.

Nifty 50 : The flagship index of the NSE, comprising 50 of the largest and

most liquid companies across various sectors. Like the Sensex, the Nifty 50

serves as an indicator of the broader market and economic conditions.

How the Indian Share Market Works?

The Indian share market operates on an electronic trading system, ensuring

transparency, speed, and efficiency. Here’s a simplified breakdown of how the

market functions:

1. Stock Selection : Investors choose stocks based on various factors,

including company performance, market trends, and economic

conditions.

2. Placing Orders : Investors place buy or sell orders through brokers, who

act as intermediaries between them and the stock exchange. Orders

can be placed online through trading platforms or offline by calling

brokers.

3. Order Matching : The stock exchange uses an electronic order

matching system to match buy and sell orders. When a match is found,

the trade is executed.

4. Settlement : After the trade is executed, the clearing corporation

ensures the transfer of securities from the seller’s account to the

buyer’s account and the transfer of funds from the buyer to the seller.

The settlement process is typically completed within two business

days, referred to as the T+2 settlement cycle.

Regulatory Framework

The Securities and Exchange Board of India (SEBI) is the primary regulatory

body overseeing the Indian share market. Established in 1992, SEBI’s role is to

protect investor interests, promote transparency, and ensure fair trading

practices. It sets guidelines for market participants, regulates IPOs, and

monitors market activity to prevent malpractices like insider trading and

market manipulation.

Types of Investors

The Indian share market attracts a diverse range of investors, including:

Retail Investors : Individual investors who buy and sell securities for personal

gain. They often rely on their knowledge, research, and financial advisors to

make investment decisions.

Institutional Investors : These include mutual funds, insurance companies,

pension funds, and foreign institutional investors (FIIs). Institutional investors

typically have large capital reserves and use sophisticated strategies to

maximize returns.

Foreign Portfolio Investors (FPIs) : FPIs are overseas investors who invest in

Indian securities to diversify their portfolios. Their involvement significantly

influences market liquidity and volatility.

Investment Avenues

The Indian share market offers various investment avenues:

Equities : Stocks of companies that represent ownership. Investors earn

returns through dividends and capital appreciation.

Debt Securities : Bonds and debentures issued by companies and

governments to raise capital. They provide fixed returns and are considered

less risky than equities.

Derivatives : Financial instruments like futures and options that derive their

value from underlying assets. Derivatives are used for hedging and

speculative purposes.

Mutual Funds : Investment vehicles that pool funds from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities.

Factors Influencing the Market

The Indian share market is influenced by various factors, including:

Economic Indicators : GDP growth, inflation rates, interest rates, and

employment data impact investor sentiment and market performance.

Corporate Performance : Company earnings, management decisions, and

growth prospects directly affect stock prices.

Global Events : Geopolitical tensions, global economic conditions, and

commodity prices (like oil and gold) can cause significant market fluctuations.

Government Policies : Fiscal policies, regulatory changes, and economic

reforms play a crucial role in shaping market dynamics.

The Role of Technology

In recent years, technology has revolutionized the Indian share market. Online

trading platforms have made investing more accessible, allowing investors to

trade from anywhere. Algorithmic trading, which uses automated strategies to

execute trades, has also gained traction, contributing to higher liquidity and

efficiency. Moreover, mobile trading apps have empowered retail investors

with tools for research, analysis, and real-time trading.

Importance of the Indian Share Market

The Indian share market is a vital component of the country’s financial

system. It provides companies with access to capital, promotes investment,

and facilitates wealth creation. For investors, it offers opportunities for

diversification, growth, and income. Additionally, the market’s performance often reflects the broader economic environment, influencing government

policies and investor confidence.

The Indian share market is a dynamic and complex entity, constantly evolving

with economic changes, technological advancements, and regulatory

updates. For investors, understanding the market’s nuances is key to making

informed decisions and achieving financial goals. Whether you’re a seasoned

investor or a beginner, staying informed and adapting to market conditions is

crucial for success in the Indian share market.

Understanding Options Trading in the Stock Market

Options trading in the stock market can seem like a complex topic, but once

you break it down, it becomes much more approachable. Let’s walk through

what options are, how they work, and what you need to know to get started

with options trading.

What Are Options?

Options are financial derivatives that give you the right, but not the obligation,

to buy or sell a specific asset (usually stocks) at a predetermined price (known

as the strike price) within a specific time period. Essentially, options are

contracts, and these contracts can be bought and sold.

There are two main types of options: call and put.

1. Call Option : These give you the right to buy a stock at a certain price

before the option expires. You would buy a call option if you expect the

stock price to rise. For example, if you think Company A’s stock,

currently trading at Rs.50, will go up, you might buy a call option to

purchase the stock at Rs.55 (the strike price) within the next three

months. If the stock goes up to Rs.70, you can buy it at Rs.55 and

immediately sell it at Rs.70, making a profit (minus the cost of the

option itself).

2. Put Options : These give you the right to sell a stock at a certain price

before the option expires. You would buy a put option if you expect the

stock price to fall. For example, if you think Company B’s stock,

currently at Rs.50, will drop, you might buy a put option to sell the stock

at Rs.45 within the next three months. If the stock falls to Rs.30, you can

buy it at Rs.30 and sell it at Rs.45, again making a profit (minus the cost

of the option).

Key Terms in Options Trading

Before diving deeper, here are some essential terms to know:

Premium : The price you pay to purchase an option. It’s determined by

various factors, including the current stock price, strike price, time until

expiration, and market volatility.

Strike Price : The price at which you can buy (call) or sell (put) the underlying

stock if you exercise the option.

Expiration Date : The date by which you must decide whether to exercise the

option.

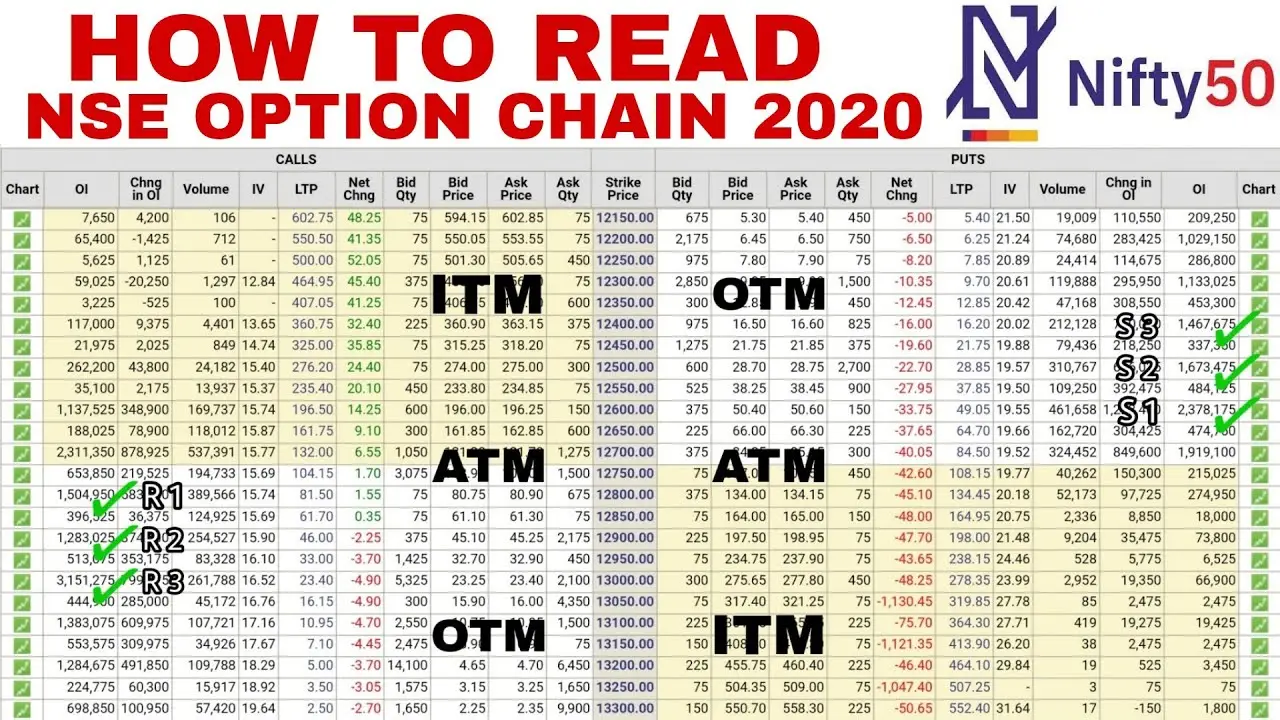

In-the-Money (ITM) : When an option has intrinsic value. For a call option, this

means the stock price is above the strike price. For a put option, it’s when the

stock price is below the strike price.

Out-of-the-Money (OTM) : When an option does not have intrinsic value. For

a call option, this means the stock price is below the strike price. For a put

option, it’s when the stock price is above the strike price.

At-the-Money (ATM): When the stock price is exactly at the strike price.

How Options Trading Works

Trading options involves predicting the direction of the stock price and

selecting the appropriate option to benefit from that movement. Here’s how

the process generally works:

1. Choosing a Strategy : Decide if you believe a stock will go up or down. If

you think it will go up, you might buy a call option. If you think it will go

down, you might buy a put option.

2. Select Your Option : Choose the strike price and expiration date for

your option. Remember, the further the expiration date, the more time

the stock has to move in your predicted direction, but this also means

the premium might be higher.

3. Buy or Sell the Option : You can either buy options (which is what most

beginners do) or sell options (which is more advanced and involves

more risk).

4. Monitor the Market : After purchasing an option, you must monitor the

market. If the stock moves in your favor, your option’s value might

increase. You can either sell the option for a profit or exercise it to

buy/sell the stock at the strike price.

5. Close or Exercise the Option : Before the expiration date, you need to

decide whether to exercise the option (buy/sell the stock at the strike

price) or let it expire worthless. You could also sell the option before

expiration to another investor if it’s profitable.

Why Trade Options?

Options offer several benefits that attract traders:

Leverage : Options allow you to control a large number of shares with a

relatively small amount of money. This can magnify your gains, but also your

losses.

Flexibility : You can use options to speculate on stock price movements,

hedge against potential losses in your stock portfolio, or generate income

through strategies like covered calls.

Risk Management : Options can be used to hedge against potential losses.

For example, if you own shares of a stock, buying put options can protect

against a decline in the stock’s price.

Risks of Options Trading

While options can be profitable, they come with significant risks:

Time Decay : The value of options decreases as they approach the expiration

date. If the stock doesn’t move as anticipated, the option can become

worthless, resulting in a total loss of the premium paid.

Volatility : The options market can be volatile. Prices can swing significantly

in short periods, leading to substantial gains or losses.

Complexity : Options trading requires a good understanding of the market,

various strategies, and how different factors affect option prices. Without this

knowledge, traders can easily incur significant losses.

Getting Started with Options Trading

If you’re interested in getting started with options trading, here are some steps

to consider:

1. Education : Learn the basics of options trading. Books, online courses,

and webinars can provide valuable insights.

2. Choose a Brokerage : Select a brokerage that offers options trading.

Ensure it has a user-friendly platform and provides the tools and

resources needed to analyze options.

3. Practice with a Paper Trading Account : Many brokerages offer paper

trading accounts where you can practice trading options without risking

real money.

4. Start Small : Begin with a small investment to test your strategies and

gradually increase your exposure as you gain experience and

confidence.

5. Stay Informed : Keep up with market news and trends, as these can

significantly impact stock prices and, consequently, options prices.

Conclusion

Options trading in the stock market is a powerful tool that can provide

significant opportunities for profit but also carries substantial risks. It’s

essential to thoroughly understand how options work, develop a solid trading

strategy, and start small as you learn. With time, experience, and proper risk

management, options trading can be a valuable addition to your investment

toolkit.