Decoding Federalism and Financial Dynamics in India

In the vast tapestry of Indian governance, federalism plays a pivotal role in shaping the nation’s political and economic landscape. It’s not just a bureaucratic term but a dynamic force that defines the distribution of powers and resources between the central government and the states. In this exploration, we delve into the intricate relationship between federalism and federal finance in the Indian context.

Table of Contents

Understanding Federalism in India

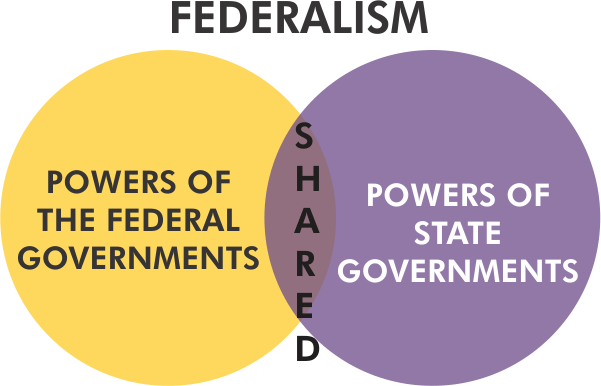

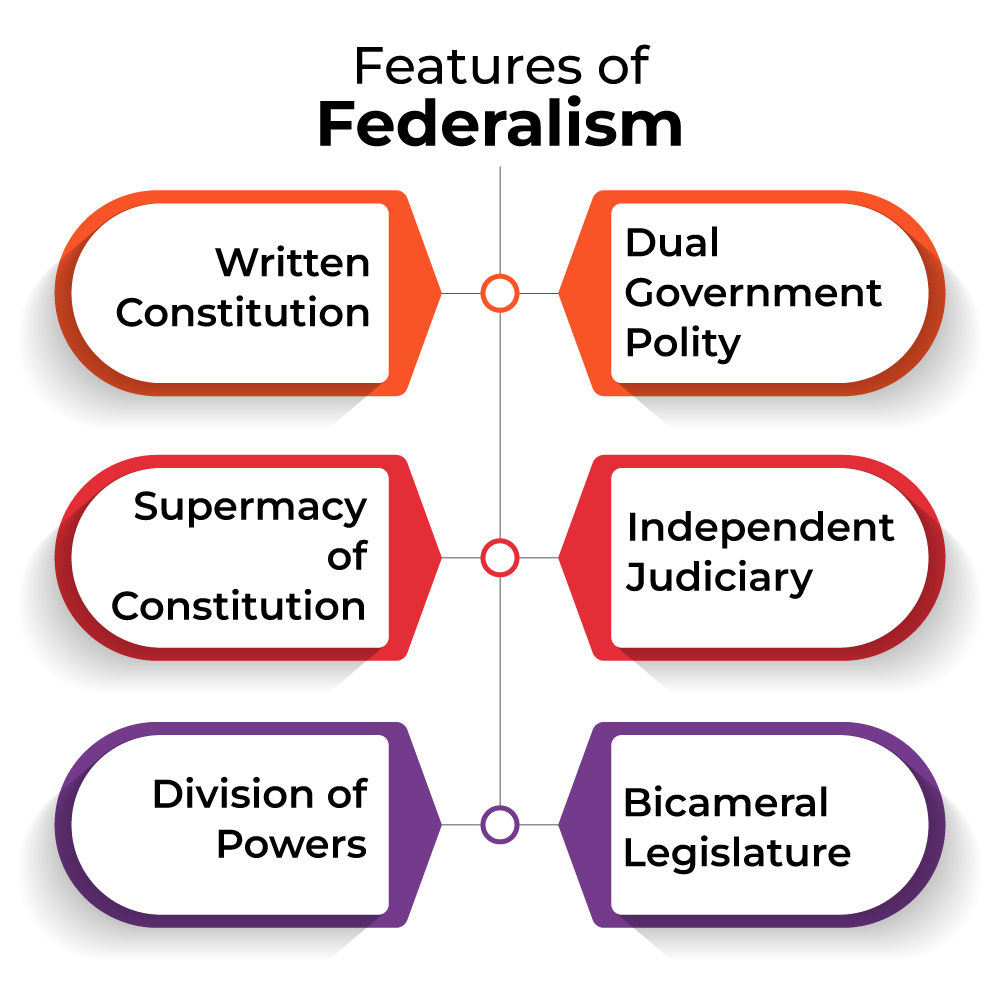

Federalism, in essence, is the distribution of powers and responsibilities between the central government and the individual states. In India, this distribution is enshrined in the Constitution, which divides the powers into three lists: Union List, State List, and Concurrent List. Each list outlines the subjects over which the respective governments have authority.

This arrangement not only empowers the states but also ensures a balance of power, preventing the concentration of authority in one entity. It allows states to address regional issues efficiently while maintaining a cohesive national identity.

The Financial Landscape

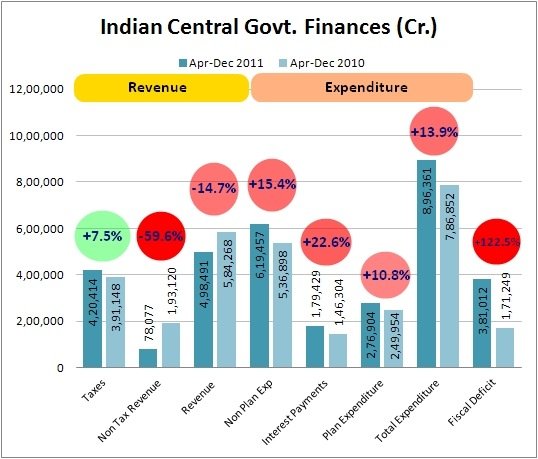

Now, let’s talk money. Federal finance is the financial relationship between the central government and the states. It involves the distribution of financial resources, taxes, and grants. In India, this financial interplay is crucial for ensuring a balanced development across the diverse states.

Tax Structure

The Goods and Services Tax (GST) is a shining example of how federalism influences taxation in India. GST replaced a complex web of indirect taxes, creating a unified tax structure. While the central government collects the GST, it is then divided between the center and the states. This ensures that all states receive a fair share of the revenue generated.

Finance Commissions

Another key player in federal finance is the Finance Commission. Constituted every five years, its primary role is to recommend the distribution of taxes between the center and states. The Commission considers factors like population, area, and fiscal capacity to determine a state’s share. This process aims to bridge the economic disparities among states.

The Challenges of Federal Finance

Despite the well-intentioned framework, challenges persist in the realm of federal finance. One notable challenge is the issue of fiscal federalism – the imbalance in revenue generation and expenditure responsibilities. Some states may struggle to meet their expenses, leading to disparities in development.

Strengthening Federalism in Finance

To address these challenges, it’s imperative to strengthen the principles of federalism in financial matters. Empowering states to raise revenue locally, enhancing their fiscal capacities, and promoting transparency in financial dealings are crucial steps.

Decentralized Planning

Encouraging states to create and execute their development plans can be a game-changer. This decentralization ensures that regional needs are accurately identified and addressed. It also fosters a sense of autonomy, promoting a more inclusive and holistic development approach.

Capacity Building

Building the financial capacity of states is crucial for effective federalism. This involves not only enhancing their revenue generation mechanisms but also providing assistance in financial planning and management. This would enable states to better navigate their financial landscape.

In the intricate field of federalism and federal finance in India, the aim is clear – to strike a balance that fosters unity in diversity. As we navigate the challenges, it’s essential to remember that a strong and vibrant federal structure is key to a flourishing nation. By addressing the financial imbalances and empowering states, India can truly harness the potential of its federal system for the benefit of all its citizens.

The Finance Commission’s Journey in Resource Redistribution (1951-2000)

As we traverse through the pages of independent India’s economic history, one institution stands out in its efforts to ensure equitable distribution of resources among states – the Finance Commission. From 1951 to 2000, this crucial body played a pivotal role in shaping the financial landscape of the nation. Join me on a journey through time as we explore how the Finance Commission facilitated the transfer of resources during these five decades.

The Genesis of the Finance Commission

Established under Article 280 of the Indian Constitution, the Finance Commission was set up with a noble purpose – to recommend the sharing of financial resources between the central government and the states. The first Finance Commission, appointed in 1951, laid the foundation for a systematic approach to fiscal federalism.

The Evolution of Resource Redistribution

Population as a Factor

One of the earliest challenges was deciding the criteria for resource distribution. The Finance Commission recognized the importance of population in this equation. However, it wasn’t a simple headcount game. The commissions sought to reward states that managed their populations well and encouraged family planning.

The Tax Pool

Over the years, the Finance Commissions introduced the concept of a tax pool, primarily through the mechanism of central taxes. This ensured a more organized and systematic approach to revenue sharing. The central government collected taxes and then allocated a share to the states based on the recommendations of the Finance Commission.

Developmental Imbalances

As India progressed, so did the disparities among states. The Finance Commission, cognizant of these developmental imbalances, worked towards a formula that would address these gaps. Factors like income, area, and fiscal capacity were considered to tailor recommendations that aimed to reduce economic disparities.

Finance Commissions: A Decade-wise Journey

1951-1960: Laying the Foundations

The first Finance Commission, under the chairmanship of K.C. Neogy, set the tone for resource redistribution. It recognized the need for a balanced approach, considering both the revenue and expenditure aspects of states.

1961-1970: Navigating Economic Shifts

As India underwent economic changes, the Finance Commission adapted its approach. The third commission, led by Mahavir Tyagi, emphasized fiscal discipline and urged states to manage their finances responsibly.

1971-1980: A Stride Towards Regional Equity

The fifth Finance Commission, under the guidance of Brahmananda Reddy, put a spotlight on regional imbalances. It recommended a significant share of resources for less developed states, marking a crucial step towards a more equitable distribution.

1981-1990: Embracing Complexity

With the nation’s economic complexities deepening, the eighth Finance Commission, headed by Y.B. Chavan, proposed a formula that considered factors like the cost of administration, distance, and topography. This nuanced approach aimed to address the unique challenges faced by different states.

1991-2000: Liberalization and Beyond

The tenth Finance Commission, during the era of economic liberalization, faced the challenge of balancing the scales amidst rapid changes. Chairman N.K.P. Salve emphasized the importance of fiscal discipline and recommended grants for local bodies, recognizing the importance of grassroots development.

Challenges and Criticisms

Despite its crucial role, the Finance Commission has not been without criticism. Some argue that the criteria used for distribution are not always reflective of a state’s actual needs, leading to disparities. Others highlight the challenge of balancing fiscal federalism with the need for a unified national vision.

Looking Ahead

As we reflect on the journey of the Finance Commission from 1951 to 2000, it becomes evident that its role is dynamic, evolving with the changing contours of India’s economic landscape. The challenge for subsequent commissions lies in adapting to new realities, addressing emerging issues, and fostering a financial framework that not only supports the growth of the nation but ensures that no state is left behind.

In the intricate dance of resource redistribution, the Finance Commission remains a key player, striving to harmonize the varied notes of economic development for a symphony that resonates across the diverse states of India.