What is a Demat Account?

A Demat account (short for Dematerialized account) is an account where you can hold your securities (like shares, bonds, ETFs, etc.) in an electronic form, instead of in physical certificates. In simple terms, it is a digital wallet for your financial assets. The concept of a Demat account came into existence to eliminate the complications and risks associated with holding physical certificates, such as loss, theft, or damage.

In India, the Securities and Exchange Board of India (SEBI) mandated the use of Demat accounts for trading in shares back in 1996. Since then, Demat accounts have become a standard requirement for anyone looking to invest in the stock market.

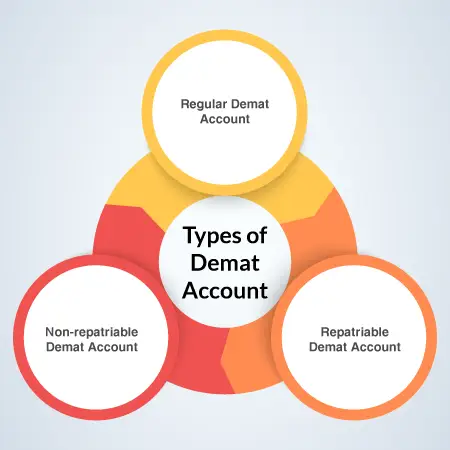

Types of Demat Accounts

There are mainly three types of Demat accounts that cater to different needs of investors:

- Regular Demat Account:

– For individual investors who want to invest in shares, bonds, mutual funds, and other financial instruments.

– This account can be opened with a depository participant (DP), who is usually a bank or brokerage firm.

– It holds all your securities electronically, making it easy to track and manage them.

- Repatriable Demat Account:

– For Non-Resident Indians (NRIs) who wish to invest in Indian markets.

– This account allows the transfer of funds (both principal and earnings) to the investor’s country of residence.

– It is linked to the investor’s NRE (Non-Resident External) or FCNR (Foreign Currency Non-Resident) bank account.

- Non-Repatriable Demat Account:

– Also for NRIs, but in this case, funds cannot be transferred abroad.

– Earnings from investments are retained within India and cannot be moved back to the investor’s country of residence.

– This type of account is linked to the investor’s NRO (Non-Resident Ordinary) bank account.

How Does a Demat Account Work?

A Demat account works in a way that when you buy securities, they are directly credited to your Demat account, and when you sell them, they are debited from your account. This eliminates the need for paper certificates, thus simplifying the process of buying, holding, and selling securities.

To open a Demat account, you need to approach a Depository Participant (DP), which can be a bank, broker, or financial institution. After submitting the required documents (like KYC details, identity proof, and address proof), your account will be activated, and you can start trading.

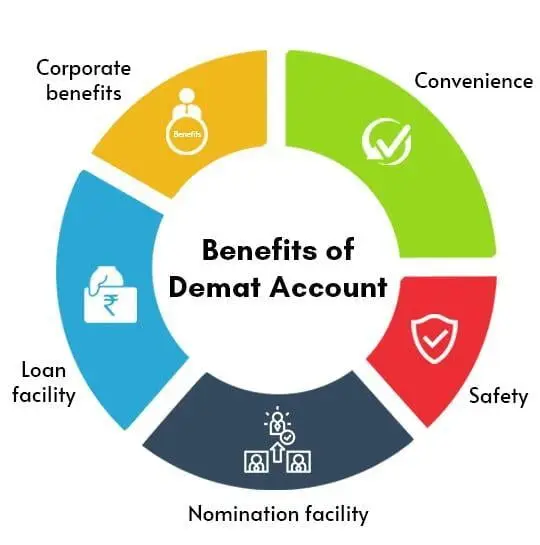

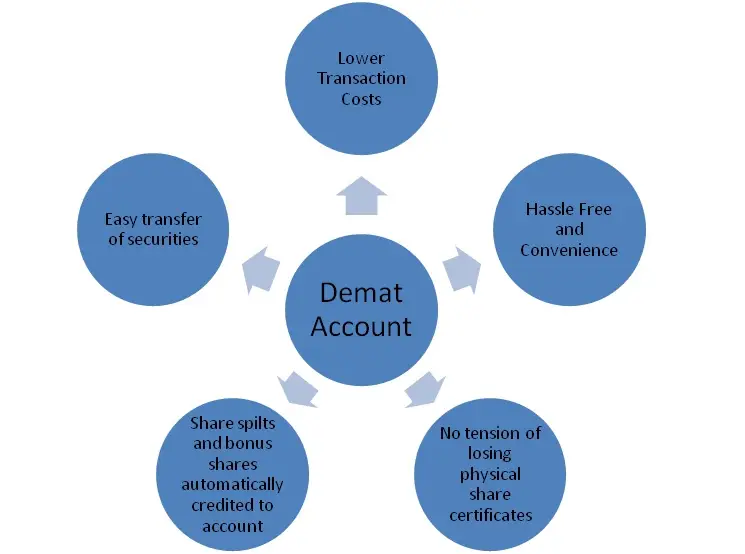

Benefits of a Demat Account

- Security and Safety:

– Holding securities in electronic form ensures that they are safe from theft, damage, or loss. Physical share certificates were prone to issues like forgery and loss, but with a Demat account, these risks are eliminated.

- Ease of Transaction:

– Buying and selling shares become seamless with a Demat account. You don’t need to deal with physical paperwork or certificates, making the process quick and efficient.

- Faster Settlement of Trades:

– With Demat accounts, securities are transferred almost instantly after a trade. This leads to quicker settlement of transactions, reducing the chances of fraud or delays.

- Reduced Paperwork:

– There is no need for documentation like share certificates or stamps when dealing in securities. All transactions are recorded electronically, making the entire process more streamlined and hassle-free.

- Online Access and Management:

– Most Demat accounts come with online access, allowing investors to check their holdings, transaction history, and even execute trades from the comfort of their homes or offices.

- Consolidation of Investments:

– A Demat account allows you to hold a variety of securities like shares, bonds, mutual funds, government securities, and exchange-traded funds (ETFs) in one place. This makes it easy to track and manage your investments.

- Nomination Facility:

– You can nominate a person to inherit your holdings in case of your unfortunate demise, making it easier for the nominee to access your investments.

- Lower Costs:

– Demat accounts reduce the need for paper certificates, thus lowering the costs related to physical transfers and handling.

- No Stamp Duty:

– When trading through a Demat account, there is no stamp duty payable on the transfer of shares, unlike when you deal with physical share certificates.

Conclusion

A Demat account is a modern and efficient way to hold and manage your investments in financial markets. It eliminates the hassles of physical certificates and offers numerous benefits like security, ease of transactions, faster settlements, and reduced paperwork. Whether you are an individual investor or an NRI, having a Demat account is essential for participating in the stock market and other financial markets today.

The main difference between a futures contract and an options contract lies in the level of obligation and flexibility they offer to the buyer and seller.

- Obligation vs. Right

– Futures Contract: When you enter into a futures contract, you are obligated to buy or sell the underlying asset at a predetermined price on a specific date in the future. Both the buyer and the seller have a binding commitment to follow through with the terms of the contract.

– Options Contract: With an options contract, the buyer has the right, but not the obligation, to buy or sell the underlying asset at a predetermined price before the contract expires. The seller (also called the “writer”) has the obligation, but only if the buyer decides to exercise the option.

- Risk and Reward

– Futures Contract: Both parties (buyer and seller) face unlimited risk because the price of the underlying asset can fluctuate significantly. If the market moves against you, you may have to cover large losses. Similarly, both parties can profit from favorable price moves.

– Options Contract: The buyer of an options contract faces limited risk. The maximum loss is the premium paid for the option, regardless of how much the market moves against them. On the other hand, the seller of an option faces potentially unlimited risk, as they could be required to fulfill the contract if the buyer chooses to exercise the option.

- Types of Contracts

– Futures Contract: It is a bilateral agreement, meaning it involves two parties agreeing to a transaction (buy and sell). The terms (like the price and delivery date) are fixed, and both parties are committed to the contract.

– Options Contract: It is a unilateral contract for the buyer. The buyer has the choice to execute the contract, while the seller is obligated to follow through if the buyer decides to exercise the option.

- Purpose and Use

– Futures Contracts: These are often used for hedging (protecting against price fluctuations) or speculation (betting on future price movements). They are commonly used by producers or consumers of commodities (like oil, wheat, etc.) to lock in prices in advance.

– Options Contracts: These are mainly used for hedging or speculation as well, but with more flexibility. The buyer might use options to limit their risk while still having the opportunity to profit from price movements.

- Settlement

– Futures Contracts: The contracts are usually settled either by physical delivery of the asset or cash settlement, depending on the terms of the contract.

– Options Contracts: Options can also be settled either by physical delivery of the asset or through cash settlement, but this happens only if the option is exercised by the buyer.

Summary:

– A futures contract obligates both parties to buy or sell an asset at a set price in the future, leading to higher risk and reward for both parties.

– An options contract gives the buyer the right (but not the obligation) to buy or sell at a set price, offering the buyer limited risk (only the premium paid) and the seller potentially unlimited risk.

In short, futures are more rigid and require action, while options offer more flexibility with the potential for limited risk for buyers.